Overseas Remittance Service User Agreement

Article 1 (Scope of Application) This ‘Terms and Conditions’ is applied to between Japan Remit Finance Co., Ltd.(hereafter referred to as the ‘Company’ and the Customer using Small Amount Overseas Remittance Service(hereinafter referred to as the ‘Service’).

Article 2 (Real Name Transaction) Customers are requested to use real name during transaction. When it is requested to verify customer’s real name by company, customers should present necessary documents such as Real Name Certificate.

Article 3 (Remittance Limit) The limitation that a customer can remit through this service follows the article 3-4 paragraph 1 of the Foreign Exchange Transaction Regulations.

Article 4 (Designated Account) ① The company shall transfer funds to the Customer only through its Bank Account (hereinafter referred to as the “Designated Account”) designated at the time of the registration of the small overseas remittance business OR the company shall receive money from the Customer in the designated account only.

② The company shall publish the matters related to the designated account on the company website and manage it with the latest contents.

Article 5 (Fees) ① If the company receives an application for use of the Service from the Customer, the company shall segregate the related fee (hereinafter referred to as “Fees”) borne by the Customer as detailed items such as the Exchange Fee, Remittance Fee.

② The company shall publish the matters related to the commission on the company website and manage it with the latest contents.

Article 6 (Applicable Exchange Rate) ① The company shall inform the Customer with applicable exchange rate when it receives an application for the use of its Services.

② The company shall publish its exchange rates on its website and manage it with the latest contents.

Article 7 (Payment and Receipt Amount) ① When the Customer applies for the service to deposit money in the designated account, the company shall transfer the amount from which the fee is deducted to foreign currency to the recipient as requested by the Customer.

② When the company receives an application for use of the Service from the Customer, the company shall provide the Customer with a statement of the original currency and the foreign currency of the amount to be paid and received by the Customer.

Article 8 (Duration of Period) ① The company shall provide the Customer with information on the estimated time required for payment or receipt when the company receives the application for the use of the Service.

② The company shall post about the estimated time required for payment or receipt on its website and keep it up to date.

③ If the Customer's transaction is not completed up to the "accept" stage within ninety (90) days from the date of initiation, the transaction shall be automatically cancelled, and the relevant funds shall be reverted to the Company.

Article 9 (Change or Cancellation of Remittance) ① The Customer can apply for the change or cancellation to the company by visiting the branch office or through online for cases where the remittance process is not complete or the payment is not made to the receiver’s account. However, the Customer can not apply for a change or cancellation for the transfer process that has been completed, such as money deposited already to the beneficiary account.

② When the company receives requests to change or cancel the remittance from the Customer, the company shall process the request and notify the Customer of the result.

Article 10 (Notification of remittance result) When the remittance process is completed, the company will notify the result of remittance immediately to the Customer by contact address provided in advance by the Customer.

Article 11 (Indemnification for damages) In the event of damages to the Customer due to the company’s responsible cause, the company’s liability for damages shall include the ordinary damages set forth in the Civil Act, and for the damages caused by special circumstances the company shall be liable for damages only if it knew or understood the circumstances.

Article 12 (Refund) ① Customer can apply for a refund to the company if the transfer is not completed within 15 days from the date the Customer submits the service to the company and transfers it to the designated account without reason for the Customer’s fault.

② When the company receives a refund application under paragraph 1, the company shall pay to the Customer the amount of money originally deposited by the Customer in the designated account and the amount of the Article 11 (compensation for damages), except in special circumstances.

Article 13 (Procedures for Dispute Resolution) ① The company shall be liable for any damages arising out of or in connection with the operation of the company. The procedures for compensating the damages suffered by the Customer in connection with the small amount overseas remittance business are hereinafter referred to as the “Dispute Settlement Procedures.” The company shall listen to and address Customer’s reasonable complaints.

② The company shall notify the Customer about the method of acceptance of the dispute (including the dispute resolution officer and the person in charge and the contact details), the dispute settlement procedure (distinguishing between simple complaint and damage claim) and the result of the dispute settlement (including processing period, customer notification method, etc.).

③ If the Customer objects to the remittance transaction process, the company may request its designated staffs (such as the dispute handling officer and the person in charge) to resolve the matter who shall notify the Customer.

④ The company shall publish the details of the dispute resolution officer and the person in charge with contact information on the company website and will update it with latest.

Article 14 (Preservation of transaction records) The company shall maintain records of payments and receipt transactions with its customers for five years pursuant to the Foreign Exchange Transactions Act and the like.

Article 15 (Confidentiality Obligation) ① Except as provided in applicable laws and regulations, the company shall not disclose any personal information (“Customer Information”) that is obtained through the execution of its overseas remittance business, such as ‘personal information of the customer, account information’, or provide to third parties without the Customer’s consent.

② If the company violates Paragraph 1 for reasons of negligent management or when theft or leakage of customer information occurs, the company is liable for damages to the victim customer. However, if the company proves that it is not intentional or negligent, it cannot be held responsible.

Article 16 (Issuance and Explanation of Terms) ① The company shall notify the terms and conditions through its website and specify the terms and conditions when making a contract with the customer for the small amount overseas remittance business.

② The company shall give the Customer a copy of the terms and conditions in the form of electronic documents (including transmission using e-mail), fax, mail or direct delivery to the Customer.

③ When the Customer asks the company to explain the contents of the terms and conditions, Japan Remit Finance must explain those to the Customer in one of the following ways:

1. Explain important contents directly to the Customer

2. Describe the important contents by electronic means recognized by the Customer.

Article 17 (Applicable Regulations) Regarding matters not defined in these Terms and Conditions, it shall be subject to relevant laws and regulations such as the Foreign Exchange Transaction Law.

Article 18 (Jurisdiction of Court) If a dispute arises in connection with the transaction, it shall be resolved by agreement of both parties. However, if both parties cannot agree or no agreement has been reached, the court will comply with the provisions of the Civil Procedure Act.

Additional clause (date of agreement)

This agreement is concluded on 2025.07.04.

Privacy Policy

We, Japan Remit Finance Co.,Ltd. according to article 30 of Personal Information Protection Act, article 27-2 of the Promotion of Information and communication network utilization and Information Protection Act, protect the personal information, rights and interests of the customers. We have the following policies.

Article 1 (Objective of Personal Information collection)

Japan Remit Finance collects personal information for the following purposes. In case the personal information is to be used for purposes other than the ones mentioned below, Japan Remit Finance will seek prior consent from the customers.

1. Membership registration and management

Japan Remit Finance collects and handles personal information for the purpose of registration, use of service, personal verification, prevention of unauthorized use, unauthorized use and verify identification of the customers.

2. Provide goods and services

Japan Remit Finance collects and handles personal information for the purpose of providing service, contents, customized services, individual verification, age verification, payments and for the purpose of resolving disputes, handling disputes, investigating financial transactions and fulfill statutory obligations.

3. Marketing and Promotion

Japan Remit Finance collects and handles personal information for the purpose of providing newly developed and customized services, promotion and participation of events, services customized for different demographic characteristics, confirmation of validity of service, access verification, and customer service.

4. Objective related to Online Transaction

Japan Remit Finance collects and handles personal information for the purpose of tracking and retrieving electronic monetary transaction, utilization of transaction data for security policy as stated by the Electronic Financial Transaction Act article 21 and 22.

Article 2 (Personal information collection and retention time period)

1. The personal information provided by the customers will be collection and retained from the day of registration as a member till the termination of the account.

However, personal information will be retained for the purposes of resolving disputes, handling complaints, investigation and fulfillment of statutory obligations as mentioned in article 1.

2. Personal information related to provision of goods and services, electronic transaction will be collected and retained from the time of consent till the transaction is completed. However, such information will be retained and used for the purpose of investigating accidents, dispute settlement, handling complaints, company’s risk management and fulfill statutory obligations.

3. Personal information related marketing and promotion will be collected and retained from the time of consent till the day of withdrawal of consent. However, such information will be retained and used for the purpose of investigating accidents, dispute settlement, handling complaints, company’s risk management and fulfill statutory obligations.

4. Personal information related to online transaction will be collected and retained for the period stated in the Electronic Financial Transaction Act article 12.

Article 3 (Provision for providing personal information to Third party)

Japan Remit Finance will restrict the use of personal information of the customers stated in article 1 and will not provide personal information to third party without the consent of the customer. However, in case of any of the following conditions or when interests of the customer or the third party is compromised, Japan Remit Finance may use the personal information for purposes other than that mentioned in article 1 or provide such information to the third party. In addition, Japan Remit Finance entrust the smooth processing of personal information system. Members have the right to refuse consent for the provision of providing personal information to third party, in such cases the customers might be restricted from using the service provided by Japan Remit Finance. Japan Remit Finance strictly complies with the laws regarding information protection, sharing personal information of the customer and prohibit providing personal information to the third party and bear the responsibilities electronically. Japan Remit Finance will notify in case of such events or change of privacy policy.

1. In case the customer has consented to providing personal information to the third party

2. In case of special regulations in other laws

3. In case, Japan Remit Finance fails to obtain prior consent from the customer or representative due to reasons such as wrong or missing address, and the information is deemed necessary for the protection of the name, body and life of the customer or the third party.

4. In case the personal information provided is deemed required for statistical analysis and research but is not written in a recognized form.

5. The company provides personal information as follows

Recipient: KFTC

Objective: Wire transfer of fund (electronic money transfer)

Retention: The information regarding payment and supply will be retained to 5 years, and as allowed and obligated by other related regulations

Recipient: Financial authorities(financial supervisory service, Bank of Korea, Ministry of Economy and Finance, KoFIU)

Objective: Foreign exchange transaction management/supervision,Anti-money laundering

Content: Foreign remittance transaction history

Retention: This is the same as the below "9. Personal Information retention period"

6. Transfer of personal information abroad

Recipient: Overseas financial institutions

Objective: Foreign remittance

Content: name, ID number, address, contact information, nationality, date of birth, cellphone number, remittance amount, remittance date, sending purpose, source of fund, occupation, gender, ID Card issue date, issuing authority, place of birth, receiver information(receiving financial institution name and branch name, name, date of birth, gender, nationality, bank account number, address, phone number, relationship, BIC Code, Province Code, Regency Code, CUP Card number, bKash number)

Retention: This is the same as the below "9. Personal Information retention period"

7. Provision for affiliate

Sell new products, service

8. Providing Personal Information

Information provided by the customer, information required to register transactions, transaction information, information other than identifiable from personal information (unique identification information like name, citizenship identification number, passport number, nationality and contact information like job, email, phone number)

Includes information collected before obtaining consent.

9. Personal Information retention period

The personal information provided will be retained from the day it is provide until the customer withdraws consent or the objective is fulfilled. After the withdrawal of consent or the fulfilment of the objective, personal information can only be retained and used for investigation of accidents, resolving disputes, handling complaints and statutory obligation.

Article 4 (Customer management duties and method)

1. The customer can request to view personal information collected by the company and the information of minors under the age of 14 (legal representatives only)

2. The customer can request the company to delete or save information that is different from the true information or can’t be confirmed. However, in case the information is specified under other regulations or laws it can’t be deleted.

3. Customer can ask Japan Remit Finance to stop processing personal information. However, under the following cases the company will notify the customer and reject the request to stop processing personal information.

① In case it is restricted by special regulation of the law or it is inevitable to comply with the statutory obligations

② There is a risk of causing harm to another person’s name, body or infringement of intellectual property and interest of others.

③ In case customer and the information regarding the termination of the contact are not clearly specified.

Article 5 ( Items of personal information)

The mandatory and optional information required for Japan Remit Finance to install, maintain, implementation, management and provide service are as follows:

1. Mandatory information

Unique identification information: name, citizenship number, gender and contact information like nationality, address, email, phone number.

Transaction information: product type, conditions for transaction, date of transaction, amount etc. information for registering and history of transaction

Other information generated through consultation for transaction, transaction registration, maintenance, implementation, management

2. Optional Information

Information provided by the customer and information required when registering as a member

3. Information collected in pursuit with the Electronic Financial transaction Act (Online transactions only)

Customer ID, password, Date and time of connection, IP address, HDD serial, MAC address, firewall settings, Os type and browser versions

Japan Remit Finance does not collect sensitive personal information which might cause infringement of personal information, but for the sole purpose of individual consent and with consent.

4. Collection method

Directly from the customer

From the mobile and homepage when subscription is registered

Homepage, written contract, fax, telephone, noticeboard, email, application details, delivery request

From the customer service through customer center.

Article 6 (personal information deletion)

Japan Remit Finance will delete personal information without delay when the personal information processing is complete. The deleting procedures, deadline and method are as follows

1. Delete procedure: The customer information is transferred to a separate database (separate documents in case of written paper) and temporarily stored for a time period and deleted in pursuit with the laws and regulations. The information stored in the DB is only used as specified by the law and not for any other process.

2. Delete deadline: The customer’s personal information is retained for 5 days from the date of collection, and deleted within 5 days after the personal information processing is complete, termination of service, operation is closed etc. In case the information is deemed not necessary it is deleted within 5 days since the day it was collected as necessary.

3. Delete method: Electronic information is deleted using technical methods so the information can’t be reproduced. In case of written paper, it is deleted using crusher or incinerated.

Article 7 (Protection of Personal Information)

Japan Remit Finance maintains a technical, managerial and physical action procedure to protect the personal information in pursuit with personal information protection act article 29.

1. Personal Information encryption

Japan Remit Finance uses encrypted password for the protection of personal information and known to the customer only and sensitive information is protect with encryption keys, file locking etc.

2. Technical measures against hacking

Japan Remit Finance installs, maintains, updates and externally monitors a security program to prevent hacking or virus that may lead to leak and or damage of personal information.

3. Access restriction

Japan Remit Finance takes necessary measures to control access to personal information through granting, modifying, and deleting access rights to the database system and controls unauthorized access externally by using an intrusion prevention system.

4. Training of personnel handling personal information

Personnel who handle personal information designated and limited in order to protect personal information.

Article 8 (Change of privacy policy)

Japan Remit Finance shall notify the change, time of implementation, changed details 7 days before the day of change thorough notice board.

Article 9 (Remedies for infringement)

Japan Remit Finance can contact the following numbers to report and consultation in case of infringement.

1. Personal information dispute mediation committee

2. KISA (www.kopico.or.kr / 02-1336)

3. ePrivacy mark (www.eprivacy.or.kr / 02-580-0533~4)

4. Advanced Criminal Investigation Division, Supreme Prosecutors' Office (www.spo.go.kr / 02-3480-2000)

5. Police Cyber Bureau (www.ctrc.go.kr / 02-392-0330)

Article 10 (Responsible person for protection of personal information)

In pursuit with personal information protection act article 31 clause 1 following will be held responsible for the protection of personal information

Responsible : Alimul Islam

Department : IT Head

contact : T 02-6927-3477

Additional clause (date of agreement)

This agreement is concluded on 2020.1.1.

Mandatory Consent form to collect, use and provide personal information

Mandatory Consent form to collect, use and provide personal information

The following conditions require mandatory consent for conducting international remittance transaction service.

Conditions for collection and use of personal information

In pursuit of Credit Information use and protection Act article 15 clause 2, article 32 clause 1, article 33 and 34 and Personal Information Protection Act article 15 clause 1, article 24 clause 1 item 1, article 24 clause 2 individual consent is required in order for Japan Remit Finance to collect, use and provide personal information related to Japan Remit Finance’s business.

Purpose of collecting and using personal information

Agreement implementation, management, maintenance, providing registered products and services, legal obligations, investigation of illegal financial transactions, dispute settlement, handling complaints

Contents of personal information to be collected ,used

Personal information: name, ID number, address, contact information, nationality, date of birth, cellphone number, email address, application password, PIN Code, ID Photo, remittance amount, remittance date, sending purpose, source of fund, occupation, gender, ID Card issue date, issuing authority, place of birth, receiver information(receiving financial institution name and branch name, name, date of birth, gender, nationality, bank account number, address, phone number, relationship, BIC Code, Province Code, Regional Code)

Transaction information: conditions for transaction, date of transaction, amount, product type etc. transaction registration information and registration of transaction

Customer’s ID, date of access, IP address, previous telephone number etc. and information stated in the electronic financial transaction act.

Includes information provided before the consent

Time limit for use and retention if personal information

The time limitation for Japan Remit Finance to use and retain information is 5 years from the day of termination of all the agreement signed with Japan Remit Finance and cancellation of service. (However, if a time limit is specified in the regulations of the related act the time limit will adhere to the act). Here after the information will only be used for investigation of error in transaction, settling disputes, handling complaints or fulfillment of legal obligations.

Management of refusal of consent and disadvantages related to refusal of consent

Consent for collecting and use of personal information is mandatory to conduct and maintain transactions.

I Agree to collection and use of personal information by the company for the purpose mentioned above.

I Agree to the collection and use of personal identification information by the company for the purpose stated above.

Personal identification information as defined in article 24 of the Personal information protection act like citizenship number, passport number, driving license, alien registration number etc.

Providing essential personal credit information to third parties

I am concerned with Japan Remit Finance business If Japan Remit Finance provides personal information to a third party pursuant to Articles 17, 22 and 24 of the 「Personal Information Protection Act」 and Article 32 of the 「Use and Protection of Credit Information Act」, Must be obtained. I hereby agree that Japan Remit Finance will provide my personal information to a third party as follows

Recipient: KFTC

Objective: Wire transfer of fund (electronic money transfer)

Content: KFTC user token, KFTC user update token, KFTC user number, Fintech user number

Retention: The information regarding payment and supply will be retained to 5 years, and as allowed and obligated by other related regulations

Recipient: Financial authorities(financial supervisory service, Bank of Korea, Ministry of Economy and Finance, KoFIU)

Objective: Foreign exchange transaction management/supervision,Anti-money laundering

Content: Foreign remittance transaction history

Retention: This is the same as the above "3. Time limit for use and retention if personal information"

Recipient: Overseas financial institutions

Objective: Foreign remittance

Content: name, ID number, address, contact information, nationality, date of birth, cellphone number, remittance amount, remittance date, sending purpose, source of fund, occupation, gender, ID Card issue date, issuing authority, place of birth, receiver information(receiving financial institution name and branch name, name, date of birth, gender, nationality, bank account number, address, phone number, relationship, BIC Code, Province Code, Regional Code)

Retention: This is the same as the above "3. Time limit for use and retention if personal information"

Management of refusal of consent and disadvantages related to refusal of consent

Consent for collecting and use of personal information is mandatory to conduct and maintain transactions.

I agree to collection and use of personal information by the company for the purpose mentioned above.

Additional clause (date of agreement)

This agreement is concluded on 2020.1.1.

Optional Consent form to collect, use and provide personal information

The consent forms are not mandatory for the agreement and can be refused. However, refusing consent may limit services (discount coupons, gifts), new product (service) introduction, promotional events provided by the company. There is no limitation regarding international remittance.

Conditions for collection, use of optional personal information

Consent is required in pursuit with article 15 clause 2, article 32 clause 1, article 33 and 34 of credit information use and protection related act, article 15 clause 1 item 1, article 17 clause 1 item 1, article 22 clause 2 of personal information protection act to collect and use customer’s personal information in order to provide introduction and sales of the company’s product.

1. Purpose of collecting and using personal information

Introduction of product and services of the company and affiliates, purchase invitation, market research and product, service R&D and customer satisfaction investigation.

2. Personal information to be collected and used

Personal information required to collect and use

3. Time limit for use and retention of personal information

The information will be used and retained until the agreement is cancelled or consent is withdrawn. Here after,the information will not be used for other purpose than investigation of financial transactions, settling dispute, fulfillment of legal obligation.

I Agree to collection and use of personal information by the company for the purpose mentioned above.

Notification regarding service, affiliate’s services marketing events, will be sent through the medium selected among phone, mobile, SMS, email etc.

Conditions related to optional personal information

1. I consent to the company or the company’s affiliate collecting and using my personal information, for promotion and sale of the company and affiliates and providing my personal information to the 3rd party mentioned below for marketing events

Receiver : companies that make gifts, prizes

Purpose : delivery of gifts, goods, prizes

Provided information : name, address, phone number

Receiver : KT, LG etc SMS service provider

Purpose: send gifts, prizes, information through SMS

Provided information : name, phone number

Receiver : Contents provider via call center

Purpose : information of service, purchase offer, customer service through phone

Information provided: personal identification information and transaction information

Receiver : affiliates and subsidiaries

Purpose: information and purchase offer of products service of affiliates and subsidiaries

Information provided: personal identification information

2. Use and retention time limit for personal information of the receiver

Incase of business consignment the time limit is set with consent. The information will be retained from the day of consent for a period of 2 years or when the agreement is terminated. Here after, the information will not be used for other purpose than investigation of financial transactions, settling dispute, fulfillment of legal obligation.

I Agree to collection and use of personal information by the company for the purpose mentioned above.

Additional clause (date of agreement)

This agreement is concluded on 2020.1.1.

Complaints and dispute settlement procedure

Article 1(Purpose) The purpose of this dispute resolution document is in accordance to Article 13 of Terms of Use Transactions (hereafter “Terms of Use”), which is to resolve justifiable dissatisfactions or implement opinions of customers, and to define the process and operate compensation for any damages occurred.

Article 2(Customer Complaint)

1. Method of reception

1) Tel. : 1522-8068

2) E-mail : help@jpremit.co.kr

2. Processing period : Within 15 business days. However if it is postponed due to natural disaster, local situation, it will be noticed in advance.

3. Response regarding processing result of customer complaints : The result will be noticed via what the customer wants to.

Article 3(Complaints and dispute settlement organization) In accordance with Article 13-3 of the Terms of Use of Remittances Service, the client may request the Complaints and dispute settlement organization to resolve the matter if customers have any objection to the handling of the remittance transaction.

1. Manager

1) Department and position : IT Head

2) Name : Alimul Islam

3) Contact : 02-6927-3477, alimul.islam@jpremit.com

2. Dispute Resolution Manager

1) Department and position : JRF Korea, Compliancer

2) Name : Taehwan Jun

3) Contact: 070-7510-3384, t.jun@jpremit.com

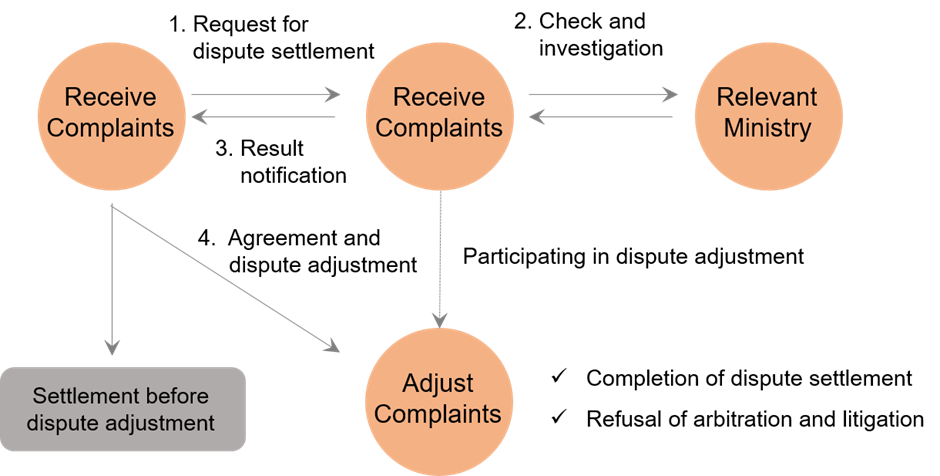

Article 4(Procedure) The company provides the following procedures for complaints and dispute settlement by separating complaints and damage requirements.

1. Receive complaints

We accept customer complaints related to our remittance services via phone or e-mail. All complaints will be delivered to manager without any distinction between complaints and damage requirements. At the same time, the customer will be notified of that.

2. Check and investigation

The manager shall verify the facts of the complaints via in various ways, including the relevant ministries, officials, and e-mail. This procedures will take up to 15 business days. However, if it is postponed due to natural disaster, local situation, it will be noticed in advance.

3. Result notification

The result will be notified to customers based on verified facts. Complaints are handled through immediate follow-up actions. In case of the damage requirements claim is carried out through the Complaints and dispute settlement organization.

4. Progress of settlement and adjustment

In the case of a damage requirements, that shall be carried out in accordance with the procedure of the Complaints and dispute settlement organization when damages occur to the customer due to the company's responsible reasons. The customer may withdraw application if a mutually amicable agreement is reached before the dispute settlement process or during the dispute settlement process.

5. Completion of Dispute Settlement

If the customer has accepted the final decision to arbitrate the dispute through the dispute settlement process of the Complaints and dispute settlement organization, it is deemed that the dispute settlement agreement has been established. The result of dispute settlement will be notified to the applicant in writing or via e-mail. Following to this result, Japan Remit Finance will process damages to customers under Article 11 of the Terms of Use. If the customer does not accept the final dispute settlement decision, the applicant can refuse to adjust or file a lawsuit.